As an Trader, however, your choices aren't limited to stocks and bonds if you end up picking to self-direct your retirement accounts. That’s why an SDIRA can remodel your portfolio.

Creating probably the most of tax-advantaged accounts means that you can keep much more of The cash that you simply devote and generate. Depending on no matter whether you end up picking a traditional self-directed IRA or simply a self-directed Roth IRA, you might have the potential for tax-cost-free or tax-deferred growth, offered sure disorders are met.

This features knowing IRS laws, handling investments, and avoiding prohibited transactions which could disqualify your IRA. A lack of data could result in highly-priced mistakes.

Range of Investment Selections: Ensure the service provider will allow the categories of alternative investments you’re enthusiastic about, including real estate, precious metals, or personal equity.

No matter whether you’re a monetary advisor, investment issuer, or other monetary Qualified, take a look at how SDIRAs could become a robust asset to mature your company and attain your professional goals.

Opening an SDIRA can give you access to investments Typically unavailable through a bank or brokerage company. Here’s how to begin:

No, You can't put money into your personal organization which has a self-directed IRA. The IRS prohibits any transactions involving your IRA and your personal enterprise since you, since the proprietor, are viewed as a disqualified man or woman.

Real-estate is one of the preferred solutions among the SDIRA holders. That’s for the reason that you can put money into any type of real estate with a self-directed IRA.

Complexity and Responsibility: Having an SDIRA, you have got additional Regulate in excess of your investments, but In addition, you bear extra obligation.

Incorporating income directly to your account. Understand that contributions are matter to annual IRA contribution restrictions established with the IRS.

The most crucial SDIRA regulations from the IRS that buyers want to understand are investment restrictions, disqualified folks, and prohibited transactions. Account holders should abide by SDIRA policies and polices to be able to preserve the tax-advantaged status of their account.

Feel your friend could possibly be setting up the following Fb or Uber? Having an SDIRA, you can spend money on brings about that you believe in; and potentially love better returns.

Increased investment alternatives means you may diversify your portfolio over and above shares, bonds, and mutual funds and hedge your portfolio from marketplace fluctuations and volatility.

Homework: It can be termed "self-directed" for just a rationale. Having an SDIRA, that you are solely to blame for carefully studying and vetting investments.

Several buyers are stunned to learn that working with retirement cash to invest in alternative assets is possible due to the fact 1974. Nonetheless, most brokerage firms and banking companies give attention to featuring publicly traded securities, like stocks and bonds, given that click to read they Recommended Site deficiency the infrastructure and expertise to handle privately held assets, for instance real estate or private equity.

The tax rewards are what make SDIRAs interesting For a lot of. An SDIRA could be both equally common or Roth - the account type you choose will count mostly on your investment and tax tactic. Examine together with your economical advisor or tax advisor in case you’re Uncertain and that is finest to suit your needs.

As soon as you’ve found an SDIRA company and opened your account, you may well be pondering how to really start investing. Comprehension both of those the rules that govern SDIRAs, along with tips on how to fund your account, may also help to put the muse for just a way forward for successful investing.

Prior to opening an SDIRA, it’s crucial to weigh the potential pros and cons based on your unique fiscal targets and risk tolerance.

Increased Fees: SDIRAs typically feature increased administrative charges in comparison to other IRAs, as particular aspects of the executive course of action can't be automated.

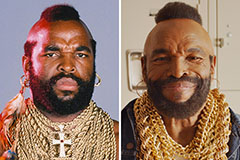

Mr. T Then & Now!

Mr. T Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now!